Hokel Real Estate Team Blog

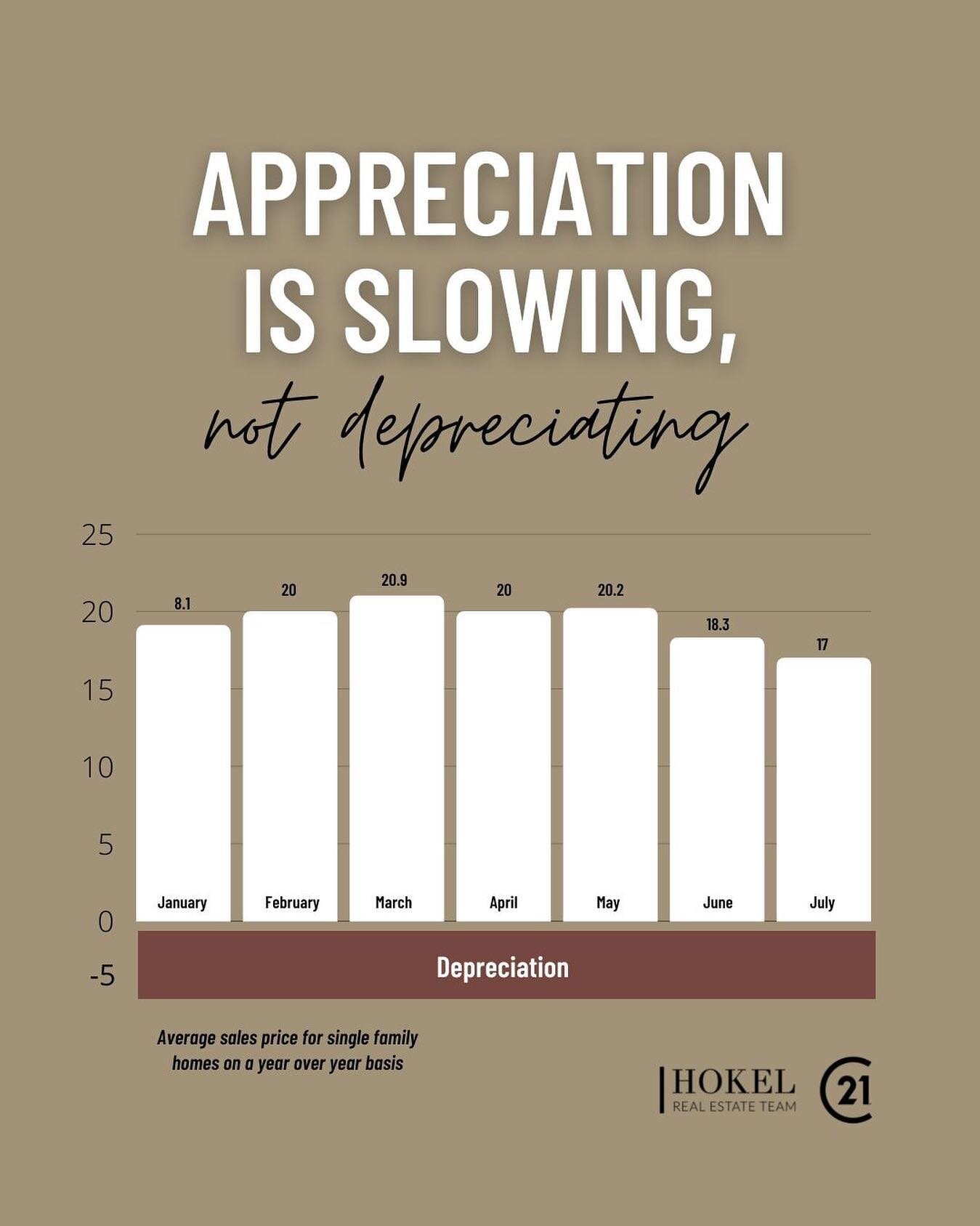

Real Estate Market Update: Home Prices, Inventory & What It Means for Buyers

Here’s how to make the most of today’s market:

Get pre-approved before you start searching. Sellers take offers more seriously when financing is locked in.

Work with a local agent who knows Ankeny micro-trends. Neighborhoods and price bands can behave differently.

Don’t skip inspections. With more inventory, buyers have negotiating power — use it.

Have a realistic budget. Even with moderate pricing gains, affordability still matters.

Good News for Homebuyers: Interest Rates Are Trending Down

Economists generally expect mortgage rates to remain above historic lows through 2026, even as they trend lower compared to the recent past. That means while this isn’t a return to pandemic-era rates, it is a meaningful improvement.

For local buyers and sellers, that translates to:

More confidence staging and listing homes

Sharper competition among lenders

Buyers who can afford slightly more without stretching budgets

2026 Housing Market Predictions

Ankeny’s 2026 housing market is shaping up to be stable, predictable, and moderately growing, a contrast to the frenetic price surges of earlier years. Buyers will have opportunities, sellers can still find good demand, and investors can count on solid fundamentals.

Affordability pressures, mortgage rates, and inventory levels will be the key forces shaping decisions this year. Staying informed, partnering with knowledgeable local agents, and acting strategically will pay off whether you’re buying, selling, or holding.

Best Neighborhoods in Ankeny, Iowa for Families, Schools, and Commute (2025 Guide)

Which Ankeny Neighborhood Is Best for Your Family?

To summarize:

Prairie Trail → Best for walkability + modern amenities

Northwest Ankeny → Best for space, quiet, and nature

Northeast Ankeny → Best for schools + convenient everyday living

Centennial/Aspen Ridge → Best for new construction and long-term growth

The right neighborhood depends on your family’s lifestyle, budget, and daily needs — but the good news is that Ankeny offers strong schools, safe communities, and high quality of life across the board.

Common Mistakes First-Time Homebuyers Make in Iowa (and How to Avoid Them)

Buying your first home in Iowa doesn’t have to be stressful. With the right preparation—strong financing, a trusted real estate agent, and awareness of local market quirks—you can avoid common mistakes and find a home that fits your budget, lifestyle, and long-term goals.

Benefits of Hiring a Local Real Estate Agent

If you’re thinking about buying or selling a home, one of the first questions that comes up is: should I use a realtor, or can I do it myself? With so many online tools available, it’s tempting to think you can handle the process solo. But working with a local real estate agent can make all the difference — especially when it comes to pricing, negotiation, and avoiding costly mistakes.

How Long Does It Take to Close a Home in Iowa?

If you’re buying or selling a home in Iowa, you’re probably wondering how long it takes to actually close the deal. While every transaction is unique, most Iowa home sales close in about 30 to 45 days. The exact timeline depends on factors like financing, inspections, and title work. Here’s a simple breakdown of what happens between the accepted offer and the day you get your keys.

What Credit Score Do You Need to Buy a House in Iowa?

Thinking about buying a home in Ankeny? Wondering what credit score you’ll need?

Most buyers will want a 620 or higher, but programs like FHA, VA, and USDA loans may offer more flexibility. The higher your score, the better your rate — and even small improvements can save you thousands.

Ready to see your options in Ankeny? Let’s talk!

Where to Find Down Payment Assistance in Iowa

Dreaming of owning a home in Iowa? You don’t have to cover the down payment alone! Explore programs from the Iowa Finance Authority and local cities that offer grants or loans to help you get into your first home.

Buying a Home in Ankeny: How Much Do You Really Need for a Down Payment?

Buying a home in Ankeny doesn’t always mean coming up with a massive 20% down payment. In fact, many buyers purchase with as little as 3%, and some programs even allow for 0% down. On a median-priced home in Iowa, that can mean the difference between saving nearly $45,000 or just a few thousand. Better yet, Ankeny buyers may qualify for grants and down payment assistance through the Iowa Finance Authority or local programs, which can make homeownership more accessible than many expect.

What are the current Mortgage Programs and Loan Options in Iowa?

Want Help Getting Started?

Your next steps:

Get pre-qualified by a lender that participates in IFA programs

Look up USDA eligibility for your dream neighborhood

Take a free homebuyer education course (required for IFA assistance)

Need help finding an IFA-approved lender or calculating what you qualify for? Reach out, we’re happy to guide you through the process.

50021 vs 50023: Which Ankeny Zip Code Fits Your Budget?

50021 vs 50023: Which Ankeny Zip Code Fits Your Budget?

Practice buying a mortgage before buying a home

First-time Homebuyer TIP: Practice paying a mortgage before buying a home

Multiple offers are back, but not for every house

Multiple offers are back, but not for every house

Four home improvements that will make you money

FOUR HOME IMPROVEMENTS THAT WILL MAKE YOU MONEY

Follow us on Instagram