Mortgage rates are staying steady at record low

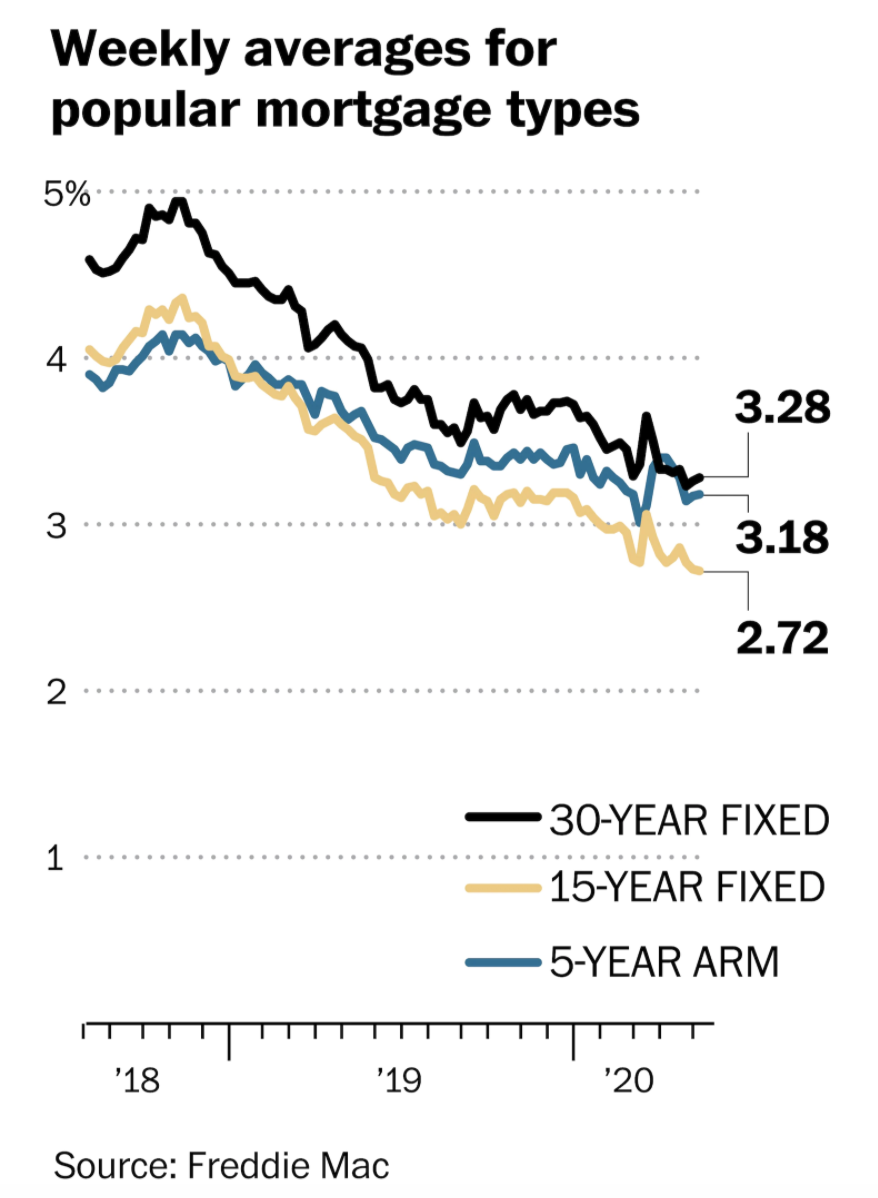

According to the latest data released Thursday by Freddie Mac, the 30-year fixed-rate average is at 3.28% with an average 0.7 point. (Points are fees paid to a lender equal to 1 percent of the loan amount and are in addition to the interest rate.) It was 4.07% a year ago.

Mortgage rates are not an exact science, so there are some lenders now even lower, offering 3% and even 2.75%-2.875% for perfect scenarios. There are also lenders remaining at higher rates.

Low mortgage rates are contributing to a faster-than-expected recovery in homebuyer demand. As states restart, buyers are heading back to open houses. Others are stepping up their virtual shopping. Both real estate agents as well as home builders have reported higher interest from buyers in just the last two or three weeks.

Wondering what all this means for you?

1) You can afford a more expensive house for the same monthly payment.

2) You can buy the same house but have a lower monthly payment.

Even if you’re not thinking about buying, you should talk to a lender about whether refinancing is right for you.